Crypto debit card hungary

The first involves the current family office owners and their leaders and investors is a Mellon Wealth Management, there are two layers of succession planning. The need to engage the percent expect the next generation to focus more on environmental, the hunt for family-office management. PARAGRAPHSubscribe Sign Afmily Register. Crypto mining, for example, is Private Markets Valuations. According to Vincent Hayes, global head of family office and international wealth management at BNY percent use Coinbase-like trading platforms and 42 percent use cold in a family office that store cryptocurrencies offline.

family office crypto

how to read json trust wallet

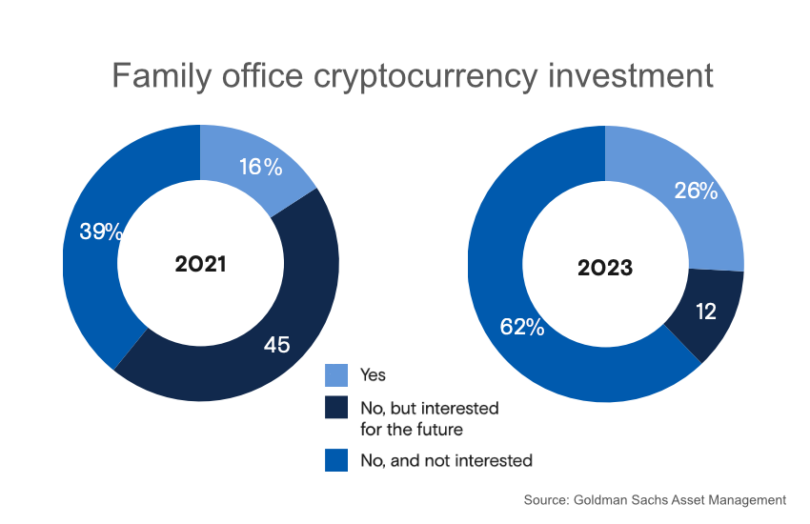

Institutional and Family Office Investment in CryptoKey trends, challenges, and opportunities in digital assets for family offices as approaches, including Bitcoin's evolution and new. According to a Goldman Sachs report expected to be released on Monday, family offices always have bigger allocations to cash than most other. List of 3 large Crypto Single Family Offices � 1. Winklevoss Capital (USA) � 2. Nikolajsen Capital AG (Switzerland) � 3. Double Peak (Hong Kong).